Temporary Assistance to Needy Families (Tanf) Had Two Major Goals. They Were:

Official seal | |

HHS Logo | |

| Program overview | |

|---|---|

| Preceding Program |

|

| Jurisdiction | Federal government of the U.s. |

| Almanac upkeep | $17.35 billion (FY2014)[i] |

| Website | TANF |

Temporary Assistance for Needy Families (TANF ) is a federal assistance plan of the U.s.. It began on July 1, 1997, and succeeded the Aid to Families with Dependent Children (AFDC) programme, providing cash assistance to indigent American families through the United States Department of Health and Human Services.[2] TANF is often only referred to as welfare.

The TANF plan, emphasizing the welfare-to-work principle, is a grant given to each land to run its own welfare program and designed to be temporary in nature and has several limits and requirements. The TANF grant has a maximum benefit of ii consecutive years and a five-year lifetime limit and requires that all recipients of welfare help must find work inside ii years of receiving assist, including single parents who are required to piece of work at to the lowest degree 30 hours per week opposed to 35 or 55 required by two parent families. Failure to comply with work requirements could result in loss of benefits. TANF funds may be used for the following reasons: to provide assistance to needy families so that children can exist cared for at domicile; to end the dependence of needy parents on government benefits by promoting job preparation, piece of work and marriage; to prevent and reduce the incidence of out-of-matrimony pregnancies; and to encourage the formation and maintenance of ii-parent families.

Background [edit]

Prior to TANF, Aid to Families with Dependent Children was a major federal assistance plan that was coming under heavy criticism. Some argued that such programs were ineffective, promoted dependency on the government, and encouraged behaviors detrimental to escaping from poverty.[3] Some people also argued that TANF is detrimental to its recipients because using these programs accept a stigma attached to them, which makes the people that use them less probable to participate politically to defend this program, and thus the programs have been subsequently weakened. First with President Ronald Reagan'south administration and continuing through the starting time few years of the Clinton administration, growing dissatisfaction with AFDC, especially the ascension in welfare caseloads, led an increasing number of states to seek waivers from AFDC rules to permit states to more stringently enforce work requirements for welfare recipients. The 27 per centum increase in caseloads betwixt 1990 and 1994 accelerated the push by states to implement more radical welfare reform.[iv]

States that were granted waivers from AFDC program rules to run mandatory welfare-to-work programs were as well required to rigorously evaluate the success of their programs. Every bit a result, many types of mandatory welfare-to-work programs were evaluated in the early 1990s. While reviews of such programs found that most all programs led to significant increases in employment and reductions in welfare rolls, there was little evidence that income amongst former welfare recipients had increased. In effect, increases in earnings from jobs were offset by losses in public income, leading many to conclude that these programs had no anti-poverty effects.[v] However, the findings that welfare-to-piece of work programs did accept some outcome in reducing dependence on government increased support among policymakers for moving welfare recipients into employment.[half-dozen]

While liberals and conservatives agreed on the importance of transitioning families from government help to jobs, they disagreed on how to accomplish this goal. Liberals thought that welfare reform should expand opportunities for welfare mothers to receive training and piece of work experience that would help them raise their families' living standards by working more and at higher wages.[6] Conservatives emphasized work requirements and time limits, paying trivial attention to whether or not families' incomes increased. More specifically, conservatives wanted to impose a five-year lifetime limit on welfare benefits and provide block grants for states to fund programs for poor families.[7] Conservatives argued that welfare to work reform would be beneficial by creating role models out of mothers, promoting maternal cocky-esteem and sense of control, and introducing productive daily routines into family unit life. Furthermore, they argued that reforms would eliminate welfare dependence past sending a powerful bulletin to teens and immature women to postpone childbearing. Liberals responded that the reform sought by conservatives would overwhelm severely stressed parents, deepen the poverty of many families, and force young children into unsafe and unstimulating child intendance situations. In improver, they asserted that welfare reform would reduce parents' power to monitor the behaviors of their children, leading to problems in child and boyish functioning.[8]

In 1992, equally a presidential candidate, Nib Clinton pledged to "end welfare as we know information technology" by requiring families receiving welfare to work afterward two years. As president, Clinton was attracted to welfare expert and Harvard University Professor David Ellwood's proposal on welfare reform and thus Clinton somewhen appointed Ellwood to co-chair his welfare task force. Ellwood supported converting welfare into a transitional system. He advocated providing assistance to families for a express time, after which recipients would be required to earn wages from a regular job or a piece of work opportunity program.[6] Depression wages would be supplemented by expanded taxation credits, admission to subsidized childcare and wellness insurance, and guaranteed child support.

In 1994, Clinton introduced a welfare reform proposal that would provide chore preparation coupled with time limits and subsidized jobs for those having difficulty finding work, just it was defeated.[seven] Afterwards that year, when Republicans attained a Congressional majority in November 1994, the focus shifted toward the Republican proposal to end entitlements to assistance, repeal AFDC and instead provide states with blocks grants.[ix] The debates in Congress about welfare reform centered around five themes:[9]

- Reforming Welfare to Promote Work and Time Limits: The welfare reform discussions were dominated by the perception that the then-existing cash assistance program, AFDC, did not do enough to encourage and require employment, and instead incentivized non-piece of work. Supporters of welfare reform also argued that AFDC fostered divorce and out-of-wedlock birth, and created a civilization of dependency on regime assistance. Both President Clinton and Congressional Republicans emphasized the need to transform the greenbacks help organization into a work-focused, fourth dimension-express program.

- Reducing Projected Spending: Republicans argued that projected federal spending for depression-income families was too high and needed to be reduced to lower overall federal spending.

- Promoting Parental Responsibility: There was broad agreement amongst politicians that both parents should support their children. For custodial parents, this meant an emphasis on work and cooperation with child support enforcement. For not-custodial parents, it meant a set of initiatives to strengthen the effectiveness of the child support enforcement.

- Addressing Out-of-Marriage Nativity: Republicans argued that out of spousal relationship nativity was presenting an increasingly serious social problem and that the federal authorities should work to reduce out-of-union births.

- Promoting Devolution: A common theme in the debates was that the federal regime had failed and that states were more successful in providing for the needy, and thus reform needed to provide more power and authority to states to shape such policy.

Clinton twice vetoed the welfare reform bill put forrad past Newt Gingrich and Bob Dole. Then just before the Democratic Convention he signed a third version after the Senate voted 74–24[x] and the Firm voted 256–170[11] in favor of welfare reform legislation, formally known as the Personal Responsibility and Work Opportunity Reconciliation Act of 1996 (PRWORA). Clinton signed the nib into constabulary on Baronial 22, 1996. PRWORA replaced AFDC with TANF and dramatically changed the way the federal government and states determine eligibility and provide aid for needy families.

Before 1997, the federal government designed the overall program requirements and guidelines, while states administered the program and determined eligibility for benefits. Since 1997, states take been given block grants and both design and administer their own programs. Admission to welfare and amount of assistance varied quite a scrap past state and locality nether AFDC, both because of the differences in land standards of demand and considerable subjectivity in caseworker evaluation of qualifying "suitable homes".[12] However, welfare recipients nether TANF are actually in completely unlike programs depending on their state of residence, with different social services available to them and different requirements for maintaining aid.[13]

State implementations [edit]

States accept large amounts of breadth in how they implement TANF programs.[xiv] [fifteen] [16] [17]

- Alabama: The Family unit Help Program

- Alaska: The Alaska Temporary Assist Program

- Arizona: Cash Assist

- Arkansas: Arkansas TANF

- California: CalWORKs

- Colorado: Colorado Works Program

- Connecticut: Connecticut TANF

- Delaware: Delaware TANF

- Florida: Temporary Greenbacks Assistance

- Georgia: Georgia TANF

- Hawaii: Hawaii TANF

- Idaho: Temporary Assist for Families in Idaho

- Illinois: Illinois TANF

- Indiana: Indiana TANF

- Iowa: Family Investment Program

- Kansas: Successful Families Program

- Kentucky: Kentucky Transitional Help Programme

- Louisiana: Family Independence Temporary Assistance

- Maine: Maine TANF

- Maryland: Temporary Greenbacks Help

- Massachusetts: Massachusetts TANF

- Michigan:Cash Help

- Minnesota: Minnesota TANF

- Mississippi: Mississippi TANF

- Missouri: Temporary Assistance

- Montana: Montana TANF

- Nebraska: Aid to Dependent Children

- Nevada: Nevada TANF

- New Hampshire: The Financial Assistance to Needy Families Program

- New Bailiwick of jersey: WorkFirstNJ

- New Mexico: NMWorks

- New York: Temporary Assistance

- Due north Carolina: Piece of work First Cash Help

- North Dakota: North Dakota TANF

- Ohio: Ohio Work First

- Oklahoma: Oklahoma TANF

- Oregon: Oregon TANF

- Pennsylvania: Pennsylvania TANF

- Rhode Isle: RI Works

- Due south Carolina: TANF/Formerly Family Independence

- South Dakota: Due south Dakota TANF

- Tennessee: Families First

- Texas: Texas TANF

- Utah: Utah TANF

- Vermont: Vermont TANF Programs

- Virginia: Virginia TANF

- Washington: Washington TANF

- Westward Virginia: Family Assist

- Wisconsin: Wisconsin Works

- Wyoming: Ability Works

Funding and eligibility [edit]

Evolution of monthly AFDC and TANF benefits in the USA (in 2006 dollars)[18]

PRWORA replaced AFDC with TANF and concluded entitlement to cash help for low-income families, meaning that some families may be denied aid even if they are eligible. Under TANF, states have broad discretion to determine who is eligible for benefits and services. In general, states must apply funds to serve families with children, with the but exceptions related to efforts to reduce non-marital childbearing and promote marriage. States cannot use TANF funds to aid most legal immigrants until they have been in the country for at least v years. TANF sets forth the following work requirements in order to qualify for benefits:[nineteen]

- Recipients (with few exceptions) must work every bit soon as they are job ready or no after than ii years afterwards coming on assistance.

- Single parents are required to participate in piece of work activities for at least xxx hours per calendar week. Two-parent families must participate in work activities 35 or 55 hours a week, depending upon circumstance.

- Failure to participate in work requirements can result in a reduction or termination of benefits to the family.

- States, in financial year 2004, take to ensure that l percent of all families and 90 pct of two-parent families are participating in work activities. If a state meets these goals without restricting eligibility, information technology can receive a caseload reduction credit. This credit reduces the minimum participation rates the state must achieve to continue receiving federal funding.

While states are given more than flexibility in the blueprint and implementation of public assistance, they must do and then inside various provisions of the constabulary:[20]

- Provide assistance to needy families then that children may be cared for in their ain homes or in the homes of relatives;

- end the dependence of needy parents on government benefits by promoting task preparation, work, and marriage;

- forestall and reduce the incidence of out-of-wedlock pregnancies and constitute almanac numerical goals for preventing and reducing the incidence of these pregnancies;

- and encourage the formation and maintenance of two-parent families.

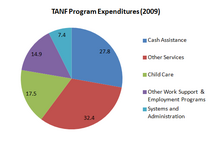

TANF Program Spending[19]

Since these four goals are deeply general, "states can use TANF funds much more broadly than the core welfare reform areas of providing a safety internet and connecting families to piece of work; some states use a substantial share of funding for these other services and program".[21]

Funding for TANF underwent several changes from its predecessor, AFDC. Under AFDC, states provided greenbacks assistance to families with children, and the federal government paid half or more of all plan costs.[9] Federal spending was provided to states on an open-concluded basis, meaning that funding was tied to the number of caseloads. Federal law mandated that states provide some level of cash assistance to eligible poor families simply states had broad discretion in setting the benefit levels. Nether TANF, states qualify for block grants. The funding for these block grants have been fixed since fiscal yr 2002 and the amount each state receives is based on the level of federal contributions to the state for the AFDC program in 1994, with no adjustments for inflation, size of caseload, or other factors.[22] [23] : 4 This has led to a dandy disparity in the grant size per child living in poverty among the states, ranging from a low of $318 per child in poverty in Texas to a high of $iii,220 per child in poverty in Vermont, with the median per kid grant size being $ane,064 in Wyoming.[23] : Figure 1 U.s. are required to maintain their spending for welfare programs at eighty percent of their 1994 spending levels, with a reduction to 75 percentage if states encounter other work-participation requirements. States take greater flexibility in deciding how they spend funds every bit long as they meet the provisions of TANF described to a higher place.

Currently, states spend only slightly more than i-quarter of their combined federal TANF funds and the land funds they must spend to see TANF'south "maintenance of endeavour" (MOE) requirement on basic assistance to come across the essential needs of families with children, and only another quarter on kid intendance for depression-income families and on activities to connect TANF families to work. They spend the rest of the funding on other types of services, including programs not aimed at improving employment opportunities for poor families. TANF does not require states to report on whom they serve with the federal or state funds they shift from cash help to other uses.[24]

In July 2012, the Section of Health and Homo Services released a memo notifying states that they are able to use for a waiver for the piece of work requirements of the TANF program. Critics claim the waiver would allow states to provide assistance without having to enforce the work component of the program.[25] The administration has stipulated that any waivers that weaken the work requirement will be rejected.[26] The DHHS granted the waivers afterward several Governors requested more than state command.[27] The DHHS agreed to the waivers on the stipulation that they continue to meet all Federal requirements.[28] States were given the right to submit their own plans and reporting methods just if they continued to meet Federal requirements and if the country programs proved to be more than effective.

Impact [edit]

Example load [edit]

Between 1996 and 2000, the number of welfare recipients plunged by half dozen.5 million, or 53% nationally. The number of caseloads was lower in 2000 than at whatever time since 1969, and the percentages of persons receiving public assistance income (less than 3%) was the lowest on record.[29] Since the implementation of TANF occurred during a period of strong economic growth, there are questions well-nigh how much of the reject in caseloads is owing to TANF program requirements. Beginning, the number of caseloads began declining after 1994, the year with the highest number of caseloads, well before the enactment of TANF, suggesting that TANF was non solely responsible for the caseload pass up.[4] Research suggests that both changes in welfare policy and economic growth played a substantial role in this pass up, and that no larger than i-third of the decline in caseloads is owing to TANF.[29] [thirty] [ needs update ]

Work, earnings, and poverty [edit]

One of the major goals of TANF was to increase piece of work among welfare recipients. During the post-welfare reform period, employment did increase among single mothers. Single mothers with children showed piffling changes in their labor strength participation rates throughout the 1980s and into the mid-1990s, simply between 1994–1999, their labor force participation rose by ten%.[four] Amongst welfare recipients, the percentage that reported earnings from employment increased from six.7% in 1990 to 28.one% by 1999.[iv] While employment of TANF recipients increased in the early years of reform, it declined in the later period after reform, particularly afterwards 2000. From 2000–2005, employment amid TANF recipients declined by 6.5%.[31] Among welfare leavers, it was estimated that shut to two-thirds worked at a hereafter betoken in time[32] [33] About 20 pct of welfare leavers are not working, without a spouse, and without any public assist.[31] Those who left welfare considering of sanctions (time limits or failure to meet programme requirements) fared comparably worse than those who left welfare voluntarily. Sanctioned welfare recipients accept employment rates that are, on boilerplate, 20 pct below those who left for reasons other than sanctions.[34]

While the participation of many depression-income single parents in the labor market has increased, their earnings and wages remained low, and their employment was concentrated in low-wage occupations and industries. 78 percent of employed low-income single parents were concentrated in iv typically depression-wage occupations: service; administrative back up and clerical; operators, fabricators, and laborers; and sales and related jobs.[35] While the average income amidst TANF recipients increased over the early years of reform, it has become stagnant in the afterwards period; for welfare leavers, their average income remained steady or declined in the later on years.[31] Studies that compared household income (includes welfare benefits) before and after leaving welfare find that between i-3rd and one-half of welfare leavers had decreased income after leaving welfare.[30] [36]

During the 1990s, poverty amid single-female parent and their families declined rapidly from 35.iv% in 1992 to 24.7% in 2000, a new historic low.[4] Notwithstanding, due to the fact that depression-income mothers who left welfare are likely to be concentrated in low-wage occupations, the pass up in public aid caseloads has not translated easily into reduction in poverty. The number of poor female-headed families with children dropped from 3.8 million to iii.1 million between 1994 and 1999, a 22% decline compared to a 48% decline in caseloads.[29] Every bit a issue, the share of working poor in the U.Southward. population rose, as some women left public assistance for employment but remained poor.[four] Most studies have found that poverty is quite high amid welfare leavers. Depending on the source of the data, estimates of poverty among leavers vary from about 48% to 74%.[32] [37]

TANF requirements have led to massive drops in the number of people receiving cash benefits since 1996,[38] but there has been little change in the national poverty rate during this fourth dimension.[39] The tabular array below shows these figures along with the annual unemployment rate.[40] [41] [42]

| Year | Average monthly TANF recipients | Poverty rate (%) | Annual unemployment charge per unit (%) |

|---|---|---|---|

| 1996 | 12,320,970 (see note) | 11.0 | 5.four |

| 1997 | 10,375,993 | 10.3 | 4.9 |

| 1998 | 8,347,136 | 10.0 | iv.5 |

| 1999 | half dozen,824,347 | 9.three | iv.ii |

| 2000 | 5,778,034 | 8.vii | 4.0 |

| 2001 | five,359,180 | 9.2 | 4.7 |

| 2002 | v,069,010 | 9.6 | v.8 |

| 2003 | 4,928,878 | 10.0 | six.0 |

| 2004 | 4,748,115 | 10.2 | 5.5 |

| 2005 | iv,471,393 | ix.9 | v.1 |

| 2006 | 4,166,659 | 9.8 | 4.6 |

| 2007 | iii,895,407 | nine.8 | iv.five |

| 2008 | 3,795,007 | ten.iii | 5.four |

| 2009 | 4,154,366 | eleven.1 | 8.1 |

| 2010 | 4,375,022 | 11.vii | 8.6 |

Note: 1996 was the last yr for the AFDC plan, and is shown for comparison. All figures are for calendar years. The poverty rate for families differs from the official poverty charge per unit.

Matrimony and fertility [edit]

A major impetus for welfare reform was business organization about increases in out-of-matrimony births and declining marriage rates, particularly among low-income women. The major goals of the 1996 legislation included reducing out-of-wedlock births and increasing rates and stability of marriages.[4]

Studies take produced only modest or inconsistent show that marital and cohabitation decisions are influenced past welfare program policies. Schoeni and Blank (2003) plant that pre-1996 welfare waivers were associated with minor increases in probabilities of marriage.[43] Notwithstanding, a like analysis of post-TANF event revealed less consistent results. Nationally, but 0.4% of closed cases gave marriage as the reason for leaving welfare.[29] Using data on marriage and divorces from 1989–2000 to examine the role of welfare reform on marriage and divorce, Bitler (2004) found that both state waivers and TANF program requirements were associated with reductions in transitions into marriage and reductions from marriage to divorce.[44] In other words, individuals who were non married were more than likely to stay unmarried, and those who were married were more likely to stay married. Her caption behind this, which is consequent with other studies, is that after reform single women were required to work more, increasing their income and reducing their incentive to give up independence for matrimony, whereas for married women, mail service-reform at that place was potentially a meaning increase in the number of hours they would take to work when single, discouraging divorce.[45] [46]

In add-on to marriage and divorce, welfare reform was also concerned about unwed childbearing. Specific provisions in TANF were aimed at reducing unwed childbearing. For example, TANF provided greenbacks bonuses to states with the largest reductions in unwed childbearing that are not accompanied by more abortions. States were also required to eliminate greenbacks benefits to unwed teens under age 18 who did not reside with their parents. TANF allowed states to impose family caps on the receipt of additional greenbacks benefits from unwed childbearing. Between 1994 and 1999, unwed childbearing among teenagers declined 20 percent amongst 15- to 17-twelvemonth-olds and x percent among 18- and 19-yr-olds.[29] In a comprehensive cross-state comparison, Horvath-Rose & Peters (2002) studied nonmarital nascency ratios with and without family cap waivers over the 1986–1996 period, and they constitute that family caps reduced nonmarital ratios.[47] Whatever fears that family caps would atomic number 82 to more than abortions was allayed by declining numbers and rates of abortion during this period.[48]

Child well-being [edit]

Proponents of welfare reform argued that encouraging maternal employment will enhance children'south cognitive and emotional development. A working mother, proponents assert, provides a positive function model for her children. Opponents, on the other hand, argued that requiring women to work at depression pay puts additional stress on mothers, reduces the quality time spent with children, and diverts income to work-related expenses such equally transportation and childcare.[29] Bear witness is mixed on the impact of TANF on child welfare. Duncan & Hunt-Lansdale (2001) found that the bear on of welfare reform varied by age of the children, with generally positive furnishings on schoolhouse achievement amidst elementary-schoolhouse age children and negative effects on adolescents, particularly with regards to risky or problematic behaviors.[49] Another study found big and meaning effects of welfare reform on educational accomplishment and aspirations, and on social beliefs (i.due east. teacher cess of compliance and self-control, competence and sensitivity). The positive effects were largely due to the quality of childcare arrangement and afterschool programs that accompanied the move from welfare to work for these recipients.[50] Still another written report found that substitution from maternal care to other informal care had caused a significant drib in performance of immature children.[51] In a program with less generous benefits, Kalili et al. (2002) found that maternal work (measured in months and hours per week) had little overall effect on children'due south antisocial behavior, anxious/depressed behavior or positive beliefs. They detect no evidence that children were harmed by such transitions; if annihilation, their mothers report that their children are meliorate behaved and have better mental health.[52]

Synthesizing findings from an extensive selection of publications, Golden (2005) reached the conclusion that children's outcomes were largely unchanged when examining children's developmental risk, including health status, behavior or emotional bug, suspensions from school, and lack of participation in extracurricular activities.[53] She argues that contrary to the fears of many, welfare reform and an increment in parental work did not seem to take reduced children's well-being overall. More abused and neglected children had not entered the child welfare arrangement. However, at the same time, improvement in parental earnings and reductions in child poverty had not consistently improved outcomes for children.

Maternal well-being [edit]

While the fabric and economic well-being of welfare mothers after the enactment of TANF has been the subject of countless studies, their mental and concrete well-beingness has received little attention. Research on the latter has institute that welfare recipients face mental and physical problems at rates that are college than the full general population.[54] Such problems which include depression, feet disorder, post-traumatic stress disorder, and domestic violence hateful that welfare recipients face many more barriers to employment and are more than at take chances of welfare sanctions due to noncompliance with work requirements and other TANF regulations[29] Research on the health condition of welfare leavers have indicated positive results. Findings from the Women's Employment Study, a longitudinal survey of welfare recipients in Michigan, indicated that women on welfare but not working are more likely to have mental health and other bug than are erstwhile welfare recipients at present working.[54] [55] Similarly, interviews with now employed welfare recipients find that partly as a issue of their increased fabric resources from working, the women felt that work has led to college self-esteem, new opportunities to expand their social support networks, and increased feelings of cocky-efficacy.[56] Furthermore, they became less socially isolated and potentially less decumbent to depression. At the same time, notwithstanding, many women were experiencing stress and exhaustion from trying to balance piece of work and family unit responsibilities.

Paternal well-existence [edit]

For single fathers inside the program, there is a small per centum increase of employment in comparison to unmarried mothers, merely there is a significant increase of increased wages throughout their fourth dimension in the program.[57] As of June 2020, the number of 1-parent families participating in TANF is 432,644.[58]

[edit]

Enacted in July 1997, TANF was set for reauthorization in Congress in 2002. All the same, Congress was unable to reach an agreement for the next several years, and as a effect, several extensions were granted to go along funding the plan. TANF was finally reauthorized under the Deficit Reduction ACT (DRA) of 2005. DRA included several changes to the original TANF program. It raised piece of work participation rates, increased the share of welfare recipients discipline to work requirements, limited the activities that could be counted every bit work, prescribed hours that could exist spent doing certain work activities, and required states to verify activities for each adult casher.[59]

In February 2009, as part of the American Recovery and Reinvestment Act of 2009 (ARRA), Congress created a new TANF Emergency Fund (TANF EF), funded at $5 billion and bachelor to states, territories, and tribes for federal financial years 2009 and 2010. The original TANF constabulary provided for a Contingency Fund (CF) funded at $2 billion which allows states meeting economic triggers to draw additional funds based upon high levels of state MOE spending. This fund was expected to (and did) run out in FY 2010. The TANF Emergency Fund provided states lxxx percent of the funding for spending increases in three categories of TANF-related expenditures in FYs 2009 or 2010 over FYs 2007 or 2008. The 3 categories of expenditures that could be claimed were basic assistance, non-recurrent curt-term benefits, and subsidized employment.[60] The third category listed, subsidized employment, made national headlines[61] as states created virtually 250,000 developed and youth jobs through the funding.[62] The program notwithstanding expired on September 30, 2010, on schedule with states drawing down the unabridged $5 billion allocated past ARRA.[63]

TANF was scheduled for reauthorization again in 2010. Nevertheless, Congress did not work on legislation to reauthorize the program and instead they extended the TANF block grant through September 30, 2011, as role of the Claims Resolution Act.[64] During this period Congress once again did not reauthorize the program but passed a three-month extension through December 31, 2011.[ needs update ]

Exiting The TANF Plan [edit]

When transitioning out of the TANF program, individuals find themselves in 1 of three situations that institute the reasons for exiting:[65]

- The first state of affairs involves piece of work related TANF leave, in which individuals no longer qualify for TANF assistance due to acquired employment.

- The second type of state of affairs is non- work TANF related get out in which the recipient no longer qualifies for assistance due to reaching the maximum time allowed to be enrolled in the assistance program. Once their time limit has been reached, individuals are removed from receiving assistance.

- The third type of situation is continued TANF receipt in which employed recipients earning a wage that does not help embrace expenses go on receiving assistance.

It has been observed that certain situations of TANF go out are more prominent depending on the geographic area which recipients live in. Focusing the comparison between metropolitan (urban) areas and not-metropolitan (rural) areas, the number of recipients experiencing not work TANF related go out is highest amongst rural areas (rural areas in the S experience the highest cases of this type of exiting the program).[65]

Data disproportion or lack of knowledge amidst recipients on the diverse TANF work incentive programs is a correspondent to recipients experiencing non work related TANF exits. Not being enlightened of the offered programs impacts their utilize and creates misconceptions that influence the responsiveness of those who authorize for such programs, resulting in longer fourth dimension periods requiring TANF services.[66] Recipients who get out TANF due to work are also affected past data asymmetry due to lack of awareness on the "transitional support" programs available to facilitate their transitioning into the work field. Programs such as childcare, food stamps, and Medicaid are meant increase piece of work incentive simply many TANF recipients transitioning into work do not know they are eligible.[67] It has been shown that TANF-exiting working women who use and maintain the transitional incentive services described above are less probable to return to receiving assistance and are more likely to experience long term employment.[68]

Criticism [edit]

Peter Edelman, an assistant secretary in the Department of Health and Human Services, resigned from the Clinton administration in protestation of Clinton signing the Personal Responsibility and Piece of work Opportunity Act, which he called, "The worst thing Nib Clinton has done."[69] According to Edelman, the 1996 welfare reform law destroyed the prophylactic net. Information technology increased poverty, lowered income for single mothers, put people from welfare into homeless shelters, and left states gratuitous to eliminate welfare entirely. It moved mothers and children from welfare to work, but many of them aren't making enough to survive. Many of them were pushed off welfare rolls because they didn't show up for an appointment, when they had no transportation to get to the appointment, or weren't informed about the appointment, said Edelman.[70] [71]

Critics afterward said that TANF was successful during the Clinton Administration when the economy was booming, but failed to support the poor when jobs were no longer available during the downturn, peculiarly the Financial crisis of 2007–2010, and particularly after the lifetime limits imposed by TANF may have been reached by many recipients.[72]

References [edit]

- ^ U.S Department of Wellness and Human Services. 2012. "TANF FY 2014 Budget." Accessed 12/two/2014 from https://www.acf.hhs.gov/sites/default/files/olab/sec3i_tanf_2014cj.pdf

- ^ U.South. Department of Health and Human Services. 2011. "TANF". Accessed 12/9/2011 from "Archived copy". Archived from the original on March 14, 2012. Retrieved March 19, 2011.

{{cite web}}: CS1 maint: archived copy as title (link) - ^ Mead, Lawrence Grand. (1986). Beyond Entitlement: The Social Obligations of Citizenship. New York: Free Printing. ISBN978-0-02-920890-eight.

- ^ a b c d east f g Blank, Rebecca. 2002. "Evaluating Welfare Reform in the United States." Periodical of Economic Literature, American Economic Clan 40(iv): 1105–116

- ^ Bloom, Dan and Charles Michalopoulos. 2001. How Welfare and Work Policies Affect Employment and Income: A Synthesis of Inquiry. New York: Manpower Demonstration Research Corporation

- ^ a b c Danziger, Sheldon (December 1999). "Welfare Reform Policy from Nixon to Clinton: What Office for Social Science?" (PDF). Gerald R. Ford School of Public Policy. Retrieved December 11, 2011. Newspaper prepared for Conference, "The Social Scientific discipline and Policy Making". Found for Social Research, University of Michigan, March xiii–14, 1998

- ^ a b Institute for Policy Research (2008). "A Look Back at Welfare Reform" (PDF). 30 (i). Northwestern Academy. Retrieved October 11, 2011. ;

- ^ Duncan, Greg J. and P. Lindsay Hunt-Lansdale. 2001. "For Better and for Worse: Welfare Reform and the Well-being of Children Families." In For Ameliorate and for Worse: Welfare Reform and the Well-being of children and Families. New York: Russell Sage Foundation

- ^ a b c Greenberg, Mark et al. 2000. Welfare Reauthorization: An Early Guide to the Issues. Center for Constabulary and Social Policy

- ^ "U.S. Senate: Roll Call Vote". senate.gov.

- ^ "Archived copy". clerk.house.gov. Archived from the original on Oct 25, 2006. Retrieved January 13, 2022.

{{cite web}}: CS1 maint: archived copy as title (link) - ^ Lieberman, Robert (2001). Shifting the Color Line: Race and the American Welfare Land . Boston: Harvard Academy Press. ISBN978-0-674-00711-half-dozen.

- ^ Kaufman, Darren S. "Aid to Families with Dependent Children (ADFC)", in Encyclopedia of Health Care Direction, ed. Michael J. Stahl. SAGE Publications, 2003, p. 17

- ^ Rowe, Gretchen (2000), "State TANF Policies as of July 1999" (PDF), Welfare Rules Database

- ^ Cook, East.A. (1962). "Ideal and Real: The Acculturation Continuum". American Anthropologist. 64 (1): 163–165. doi:10.1525/aa.1962.64.i.02a00150. JSTOR 666735.

- ^ Mazzeo, Christopher; Rab, Sara; Eachus, Susan (2003). "Work-Outset or Work-But: Welfare Reform, State Policy, and Admission to Postsecondary Pedagogy". Annals of the American University of Political and Social Scientific discipline. 586: 144–171. doi:10.1177/0095399702250212. JSTOR 1049724. S2CID 154484859.

- ^ Soss, Joe; Fording, Richard C.; Schram, Sanford F. (2008). "The Color of Devolution: Race, Federalism, and the Politics of Social Control". American Journal of Political Science. 52 (3): 536–553. doi:10.1111/j.1540-5907.2008.00328.x. JSTOR 25193832.

- ^ 2008 Indicators of Welfare Dependence Effigy TANF 2.

- ^ a b Schott, Liz. 2011. Policy Basics: An Introduction to TANF. Eye on Budget and Policy Priorities. Accessed 11/ii/2011 from http://www.cbpp.org/cms/alphabetize.cfm?fa=view&id=936

- ^ U.S. Department of Health and Homo Services. About TANF.U.Due south. Department of Health and Man Services. Accessed 11/2/2011 from "Archived copy". Archived from the original on March fourteen, 2012. Retrieved March 19, 2011.

{{cite web}}: CS1 maint: archived re-create as title (link) - ^ "Policy Nuts: An Introduction to TANF". Centre on Budget and Policy Priorities. November 17, 2008. Retrieved May 15, 2017.

- ^ Loprest, Pamela, Stefanie Schmidt, and Anne Dryden White. 2000. "Welfare Reform under PRWORA: Assist to Children with Working Families?" in Tax Policy and the Economy edited past James Thou. Poterba: 157–203

- ^ a b Falk, Gene; Carter, Jameson A.; Ghavalyan, Mariam (October ix, 2019). The Temporary Assistance for Needy Families Block Grant: Legislative Problems in the 116th Congress (Study). Congressional Enquiry Service. Retrieved Oct 23, 2019.

- ^ Schott, Liz. "How States Utilise Federal and State Funds Under the TANF Block Grant". The Center on Budget Policy and Priorities.

- ^ "Republicans accuse HHS of gutting welfare reform with quiet policy modify". FoxNews.com. July xiii, 2012. Retrieved July xix, 2012.

- ^ "Romney's starting his race to the bottom". suntimes.com. August viii, 2012. Retrieved August eight, 2012.

- ^ "3 Reasons Why Republican Governors Asked to Reform Their Welfare Programs – Center for American Progress Action Fund". americanprogressaction.org. September 6, 2012.

- ^ [1] [ dead link ]

- ^ a b c d due east f g Lichter, Daniel T. and Rukamalie Jayakody. 2002. "Welfare Reform: How Do Nosotros Measure Success?" Annual Review of Folklore 28:117–141

- ^ a b Bavier, Richard. 2001. "Welfare Reform Data from the Survey of Income and Program Participation." Monthly Labor Review (July): 13–24

- ^ a b c Acs, Gregory and Pamela Loprest. 2007. "TANF Caseload Composition and Leavers Synthesis Study". The Urban Found

- ^ a b Moffitt, Robert A. and Jennifer Roff. 2000. "The Diversity of Welfare Leavers, Welfare Children, and Families: A Three City Report." Johns Hopkins University Policy Brief 00-02

- ^ Devere, Christine. 2001. "Welfare Reform Enquiry: What Exercise We Know About Those Who Leave Welfare?" CRS Study for Congress. Washington, D.C.: Congressional Research service

- ^ Tweedie, Jack. 2001. "Sanctions and Exists: What States Know about Families that leave Welfare Considering of Sanctions and Fourth dimension Limits." In For Better and for Worse: Welfare Reform and the Well-being of Children Families. New York: Russell Sage Foundation

- ^ Peterson, Janice et al. 2002. Life After Welfare Reform: Low-income Single Parent Families, Pre- and Mail-TANF. Institute for Women's Policy Research #D446

- ^ Cancian, Maria. 2000. Earlier and Later on TANF: The Economical Well-Being of Women Leaving Welfare. Institute for Enquiry on Poverty. Special Report no.77

- ^ Loprest, Pamela. 2001. How Are Families that Left Welfare Doing? A Comparison of Early and Recent Welfare Leavers. Series B, No B-36, Assessing the New Federalism Project. Washington, D.C.: Urban Institute. April

- ^ "Caseload Data". Administration for Children and Families. Retrieved Oct 12, 2008.

- ^ "Historical Poverty Tables". U.S. Census Bureau. Archived from the original on April xix, 2008. Retrieved October 12, 2008.

- ^ "Labor Force Statistics including the National Unemployment Rate". U.Due south. Department of Labor, Bureau of Labor Statistics. Retrieved Nov 1, 2008.

- ^ TANF – Caseload Data – U.S. Department of Wellness and Human being Services, Administration for Children and Families, Role of Family unit Assistance

- ^ Number Beneath Poverty Level and Rate – Historical Data – U.S. Census, 2010

- ^ Schoeni, Robert F.; Blank, Rebecca M. (December 2003). "What Has Welfare Reform Accomplished? Impacts on Welfare Participation, Employment, Income, Poverty, and Family unit Construction" (PDF). PSC Research Report. No. 03-544.

- ^ Bitler, Marianne. 2004. "The Touch of Welfare Reform on Spousal relationship and Divorce". Demography 41(2):213–236

- ^ Harknett, 1000. and L.A. Gennetian. 2003. "How An Earning Supplement Can Affect Wedlock Formation Among Depression-Income Single Mothers." Demography xl:451-78

- ^ Ellwood, D. T. and C. Jencks. 2001. "The Growing Differences in Family Construction: What Do We Know? Where Do We Look for Answers?" Unpublished manuscript, John F. Kennedy Schoolhouse of Government, Harvard Academy, Cambridge, MA.

- ^ Horvath-Rose, A. and HE Peters. 2002. "Welfare waivers and nonmarital fertility". in For Better and For Worse: Welfare Reform and Well-Being of Children and Families. New York: Russell Sage Foundation, 222–245

- ^ Henshaw, S. M. 2001. Nativity and ballgame data. In Data Needs for Measuring Family and Fertility Change After Welfare Reform, ed. D. J. Basharov. College Park, MD: Welfare Reform University

- ^ Duncan, G. J. and L. Chase-Lansdale. 2002. For Better and For Worse: Welfare Reform and the Well-Being of Children and Families. New York: Russell Sage Foundation.

- ^ Mistry, R.S., D.A. Crosby, Air-conditioning Huston, and DM Casey, K Ripke. 2002. Lessons from New Hope: the bear on on children's well-being of a work-based anti-poverty programme for parents. Meet Duncan and Chase-Landsdale 2002

- ^ Bernal, R.; Keane, M. P. (2011). "Child care choices and children's cerebral achievement: The case of single mothers". Journal of Labor Economics. 29 (3): 459–512. CiteSeerX10.one.1.378.9391. doi:10.1086/659343. S2CID 10002078.

- ^ Kalili, Ariel et al. 2001. "Does Maternal Employment Mandated past Welfare Reform Affect Children'south Behavior?" In For Better and for Worse: Welfare Reform and the Well-being of Children Families. New York: Russell Sage Foundation

- ^ Golden, Olivia. 2005. Assessing the New Federalism, Eight Years Later. Urban Institute

- ^ a b Danziger, Due south. 1000. 2001. Why some neglect to achieve economical security: Low chore skills and mental health bug are key barriers. Forum 4(two):i–three

- ^ Pollack, H.; Danziger, S.; Jayakody, R.; Seefeldt, Thou. (2002). "Drug Testing Welfare Recipients—False Positives, False Negatives, Unanticipated Opportunities". Women's Health Issues. 12 (ane): 23–31. doi:10.1016/S1049-3867(01)00139-6. PMID 11786289.

- ^ London, A. S., Scott, Due east. K., Edin, K. and Hunter, V. (2004), "Welfare Reform, Piece of work-Family Tradeoffs, and Child Well-Being". Family Relations 53: 148–158

- ^ Peterson, Janice; Song, Xue; Jones-DeWeever, Avis (May 2002). "Life After Welfare Reform: Low-Income Single Parent Families, Pre- and Post-TANF" (PDF). Institute for Women's Policy Research.

- ^ "TANF: Total Number of I Parent Families Fiscal Year 2020" (PDF). U.Due south. Department of Health & Homo Services.

- ^ Zedlewski, Sheila and Olivia Golden. 2010. "Next Steps for Temporary Assistance for Needy Families." The Urban Establish: Brief(11) accessed Dec 12/2011 from http://world wide web.urban.org/UploadedPDF/412047_next_steps_brief11.pdf

- ^ "Questions and Answers nearly the TANF Emergency Fund" (PDF). Center for Law and Social Policy. Retrieved October 8, 2010.

- ^ Cooper, Michael (September 25, 2010). "Job Loss Looms as Part of Stimulus Expires". New York Times . Retrieved October viii, 2010.

- ^ "Walking Abroad From a Win-Win-Win Subsidized Jobs Slated to End Before long Are Helping Families, Businesses, and Communities Conditions the Recession". Center on Budget and Policy Priorities. September 2010. Retrieved October eight, 2010.

- ^ "Approved State, Territory & DC TANF Emergency Fund Applications past Category". U.S. Department of Health and Human Services, Assistants for Children and Families. Retrieved October viii, 2010.

- ^ Centre for Law and Social Policy. 2010. "TANF Reauthorization." Accessed 12/12/2011 from http://www.clasp.org/federal_policy/pages?id=0021

- ^ a b Irving, Shelley K. (December i, 2008). "State Welfare Rules, TANF Exits, and Geographic Context: Does Place Matter?*". Rural Sociology. 73 (four): 605–630. doi:x.1526/003601108786471549. ISSN 1549-0831.

- ^ Anderson, Steven G. (January 1, 2002). "Ensuring the Stability of Welfare-to-Work Exits: The Importance of Recipient Knowledge about Work Incentives". Social Work. 47 (2): 162–170. doi:ten.1093/sw/47.ii.162. JSTOR 23717936. PMID 12019803.

- ^ Anderson, Steven G.; Schuldt, Richard; Halter, Anthony P.; Scott, Jeff (January 1, 2003). "Employment Experiences and Support Services Use Following TANF Exits". The Social Policy Journal. 2 (1): 35–56. doi:x.1300/J185v02n01_04. ISSN 1533-2942. S2CID 154639073.

- ^ Acs, Gregory (Baronial 2007). "Helping Women Stay Off Welfare: The Function of Post-Exit Receipt of Work Supports". The Urban Constitute . Retrieved November 16, 2016.

- ^ Ii Clinton Aides Resign to Protest New Welfare Law by Alison Mitchell, The New York Times, September 12, 1996

- ^ Poverty & Welfare: Does Compassionate Conservatism Have a Center? Peter B. Edelman 64 Alb. Fifty. Rev. 1076 2000–2001.

- ^ The worst affair Bill Clinton has done, Peter Edelman, The Atlantic, March 1997

- ^ As Progressives Predicted, Clinton Welfare Reform Constabulary Fails Families by Randy Shaw in BeyondChron (April 19‚ 2010)

External links [edit]

- Welfare Reform and Unmarried Mothers (Yale Economical Review)

- Congressional Research Service Report on TANF

- Government Accountability Office Study on TANF

- The Center for Law and Social Policy

- Numbers On Welfare See Precipitous Increase by Sara Murray, The Wall Street Periodical, June 21, 2009

- Welfare'south prophylactic net hard to measure amid states by Amy Goldstein, "The Washington Postal service", October two, 2010

- "Office of Family Assistance (OFA)"

Source: https://en.wikipedia.org/wiki/Temporary_Assistance_for_Needy_Families

0 Response to "Temporary Assistance to Needy Families (Tanf) Had Two Major Goals. They Were:"

Post a Comment